Genesis helped a global asset manager to accelerate investment decision making, reduce data errors and capture more opportunities in the primary bond markets. Through combining deep industry knowledge, a next-generation application platform and an agile development approach, Genesis rapidly developed and deployed a fully-hosted solution to aggregate sources of new issue data, collate interest from across the organization and streamline order management.

Client Challenge

As part of their fixed-income investment strategy, the client has a team of over 150 portfolio managers, traders and analysts working collaboratively to detect new bond issuances, identify opportunities and submit firm orders for execution.

As the business had scaled across time-zones and geographies, and now incorporated multiple sources of analytics and new issuance data, the current solution of disconnected applications, emails and spreadsheets had become too inefficient and error-prone, leading to missed opportunities and potential compliance infractions.

Given that there was no vendor solution available, and that their internal IT team lacked the domain expertise and bandwidth to take on new projects, the client turned to Genesis.

The Solution

Genesis engaged with the client from the earliest stages of the project, combining deep domain knowledge, specialist engineering skills and a next-generation application platform to deliver beyond expectations.

Employing an iterative, UX-led approach, Genesis worked closely with the client to discover requirements, obtain feedback and regularly demonstrate progress, giving confidence to key users and stakeholders on timelines and solution effectiveness.

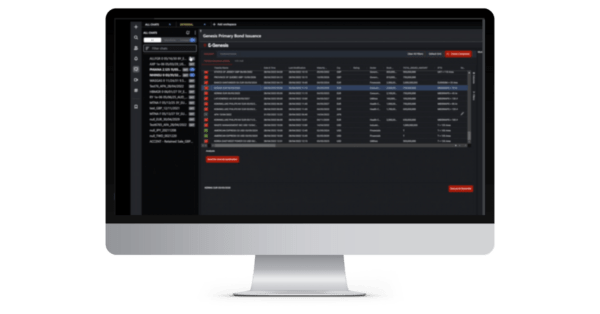

The result was the Primary Bond Issuance (PBI) Application – a fully-hosted solution which speeds up investment decision making by helping traders, portfolio managers and analysts to work together to evaluate deals.

PBI aggregates and normalizes new issue data across sources to create a central repository, provides a collaborative, end-to-end workflow connecting the whole team, and features integrations to order and execution management systems to streamline how the firm communicates orders.