Platform > Marketplace

Marketplace

Ready-to-use solutions for trading, investment management, risk and compliance are part of a library of configurable financial industry technologies that jumpstart building new applications in Genesis.

Solutions

Templates

Components

Integrations

Pre-built, full-stack industry solutions

Pre-built applications addressing financial data, workflow and compliance challenges include a multi-asset class middle-office suite, a unique application helping asset managers get bond deal allocations, a custodial services solution for brokers and much more.

Genesis solutions can be customized to meet specific needs, reducing both development time and costs.

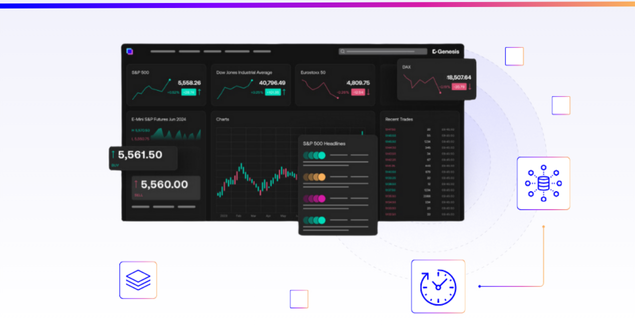

Blueprints for financial applications

Templates are launchpads for further development, featuring core business logic, data models and UI.

Providing a working foundation, they give developers a leg up in building new applications.

Off-the-shelf application drivers

Configurable application drivers act as reusable building blocks, making it fast and easy to add critical sub-functions like user- and permission management, data reconciliation, reporting and notifications to any application.

Industrywide connectivity

With pre-built integrations across a range of connectivity needs, from market data to trade systems, vendor services and industry protocols, Genesis makes it easy to source and export data.