THE CHALLENGE

Fintech firm needed a new trading platform to scale

Our client is a fintech company that offers an AI-based algo-trading solution to improve trading performance. It uses proprietary algorithms to route client orders to the most suitable broker.

They had developed an algo for improved execution performance, but didn’t have the necessary trading system to run this. So, they partnered with Genesis to build the tech needed to deliver this solution to their clients. Genesis built an OMS/EMS platform to help our client process orders.

The SOLUTION

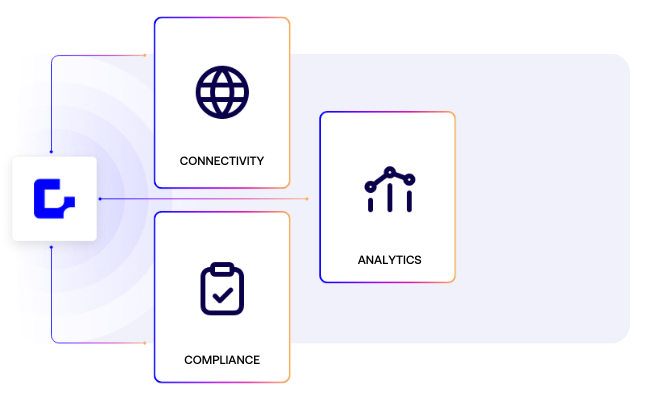

Genesis builds new trading desk

Using the Genesis Application Platform, we built an innovative trading desk capability that utilized our client’s existing algorithms to enhance their client’s execution performance.

We combined several trade-related functions, including reporting, post-trade analytics and integrations to develop a trading system tailored to the firm’s needs. This enabled the client to deliver enhanced trade performance with best execution reporting data to measure improvements.

The benefits

Our client was able to leverage Genesis’ industry expertise, detailed planning, and seamless execution throughout.

SEE GENESIS IN ACTION