Table of Contents

- The reporting challenge in the middle office

- How targeted improvements close the gap

- Extending beyond the middle office

- Next steps: How to address your reporting gaps

Get in touch to learn how Genesis can help you modernize your workflows

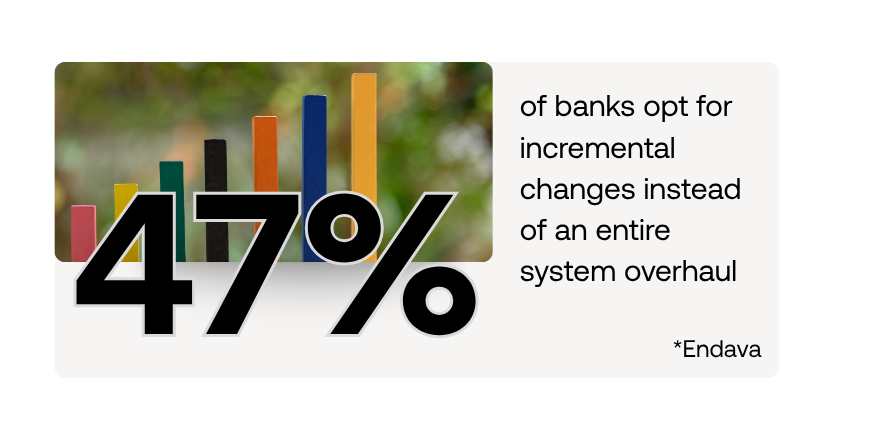

Upgrading an entire middle office system sounds ideal, but in reality, it’s costly, complex, and disruptive. A study by Endava found that only 13% of banks attempt full replacements due to the risks involved. The majority, 47%, prefer incremental upgrades instead.

Vendor lock-in, legacy dependencies, and operational risk often make large-scale replacements impractical. Yet, transformation can still happen through targeted modernization, starting with the areas that matter most.

For most institutions, reporting is one of those areas — essential for compliance, operations, and client service, but also a major source of inefficiency. By closing reporting gaps, firms can improve performance, reduce risk, and lay the foundation for broader modernization without touching every system at once.

The reporting challenge in the middle office

Middle office reporting processes are often manual, fragmented, and slow. Data is scattered across front-office platforms, custodians, and clearing houses, making it difficult to consolidate and analyze efficiently.

According to McKinsey, financial institutions spend 30–40% of their reporting time on data collection and validation, not on analysis or insight. Manual reporting often means copying and pasting data between systems, increasing the risk of errors and inconsistent outputs.

Disjointed processes also result in teams using different formats or templates, causing rework and confusion. Outdated data leaves executives with weak visibility into performance, which can lead to poor strategic decisions.

Then there’s the regulatory burden. Frameworks like TRACE (FINRA’s Trade Reporting and Compliance Engine for fixed income) and MiFID II (Europe’s Markets in Financial Instruments Directive) require institutions to capture and report detailed transaction data — over 65 data fields per trade under MiFID II alone. Missing or inaccurate data can lead to heavy fines, reputational damage, or even legal consequences.

How targeted improvements close the gap

When budgets are tight, incremental modernization is often the most effective route. In a 10x Banking study, 42% of banks said they plan to replace only parts of their legacy stack in the coming year — not the entire system.

The best place to start? Reporting automation and standardization.

1. Automate Reporting

Automating trade, risk, and regulatory reporting removes manual effort and minimizes human error. Automated tools consolidate trade and allocation data, then deliver standardized reports through secure channels like SFTP, FIX, or APIs. This ensures compatibility with downstream settlement and compliance systems.

2. Ensure Data Accuracy in Real Time

Real-time data capture and integration mean reports are always built from current, verified information. This enhances operational insight across the front, middle, and back office — giving stakeholders timely visibility into trading performance and risk exposure.

3. Stay Ahead of Regulatory Change

Modern reporting solutions adapt quickly to evolving global requirements, handling frameworks like TRACE and MiFID II out of the box. They automatically generate the required audit trails and data submissions to keep firms compliant at scale.

4. Strengthen Client Reporting

Accurate, timely, and transparent client reports are essential to maintaining trust. Automated systems improve reporting quality, making it easier to meet client expectations and respond to queries without delay.

Firms that automate reporting typically see faster cycle times, 25% lower operational costs, and up to 30% less risk exposure. By shifting repetitive report-building to technology, middle-office teams can focus on insight rather than manual data management.

Extending beyond the middle office

Reporting inefficiencies don’t stop at the middle office, they affect the entire trade lifecycle.

1. Front Office

Trade reporting to regulators and exchanges depends on clean data from trade-capture platforms. Automating those connections reduces manual input and supports timely compliance submissions.

2. Back Office

Settlement and transaction reporting require consistent upstream data. Reconciliations and notifications must align across departments to avoid mismatches or settlement failures.

3. Holistic Solutions

The most effective platforms bridge these silos. They combine reporting, reconciliation, and notifications into one configurable environment that adapts to each firm’s business logic and compliance requirements.

A single, scalable reporting framework reduces reliance on workarounds, simplifies compliance, and creates a consistent data flow across every function.

Next steps: How to address your reporting gaps

You don’t need a full replacement to modernize your reporting. Focus first on the areas with the highest regulatory or operational impact. Prioritize automation, standardization, and flexible solutions that evolve with your business.

By upgrading reporting processes, your firm can improve efficiency, enhance compliance, and strengthen client relationships; all without the cost or disruption of a system overhaul.

Ready to uncover and fix your reporting gaps?

Talk to our team to assess your current setup and explore how targeted solutions can transform reporting efficiency across your middle office and beyond.