Table of Contents

The new year is here and so are our predictions.

The financial services industry stands at a pivotal moment. Rapid advances in technology are reshaping how institutions operate, creating both unprecedented opportunities and complex challenges. As regulatory pressures intensify and market conditions fluctuate, firms must stay ahead of emerging 2025 financial market trends to remain competitive.

According to Sumeet Chabria, Senior Advisor for Genesis Global, the industry is at an “inflection point.” Financial institutions must modernize core systems, reduce reliance on outdated computing practices, and seize opportunities to digitalize key functions such as trading, compliance, and client services. These areas, historically manual and cumbersome, now represent some of the greatest opportunities for automation and innovation.

However, modernization won’t be easy. Firms face rising operational costs, talent shortages, and growing regulatory complexity — all while trying to deliver more with fewer resources. Success in 2025 will depend on a firm’s ability to balance innovation with resilience: leveraging technology to streamline operations while fostering a culture that embraces continuous improvement and agility.

This report explores key 2025 financial market trends and emerging technologies shaping the future of financial services, highlighting both the challenges firms face and practical ways to overcome them.

Part 1: Do more with your existing team and resources

The challenge: Balancing innovation and cost control

Financial institutions are being pushed to innovate while keeping costs down – a balancing act that requires strategic use of technology and smarter resource allocation.

Compliance in financial technology

As cybersecurity threats evolve, regulations and compliance in financial technology are becoming increasingly stringent. Financial institutions must now prove that their systems meet tougher global standards while maintaining real-time auditability and control.

Take the T+1 settlement cycle, which came into effect in the U.S. in May 2024. This shortened the settlement period for most securities from two days to one. For compliance teams, that meant less time to detect and report issues, forcing firms to upgrade their systems to ensure reporting accuracy and regulatory alignment under tighter deadlines.

In 2025, more regulatory changes like this are expected. To keep pace, firms are ramping up their investments in compliance technology, prioritizing automation, stronger data frameworks, and integrated monitoring systems that can manage risk proactively.

Restrained IT budget

Competition for specialist engineering talent

How Genesis helps firms increase productivity

Overcoming compliance

Genesis enables firms to address compliance challenges with real-time operational assurance. The Genesis Application Platform includes built-in encryption, auditing, and entitlement management to ensure all applications are compliant by default. Its real-time core supports the low-latency, high-throughput demands of initiatives like the T+1 settlement cycle – keeping systems both fast and auditable.

Tackling budget and talent restraints

Artificial intelligence is redefining software delivery across financial markets. As Stephen Murphy, CEO of Genesis Global, explains: “To compete for market share, reduce costs, and comply with evolving regulations, bringing applications to market quickly is key.”

Genesis enables exactly that — accelerating developer productivity and speed to market.

For example, Genesis partnered with one of the world’s leading financial groups to deliver a rapid transformation program across its securities business, building a Client Portal, an FX Trading Execution Platform, and several custom applications. The result was faster delivery, lower costs, and stronger compliance through centralized auditability and system interoperability.

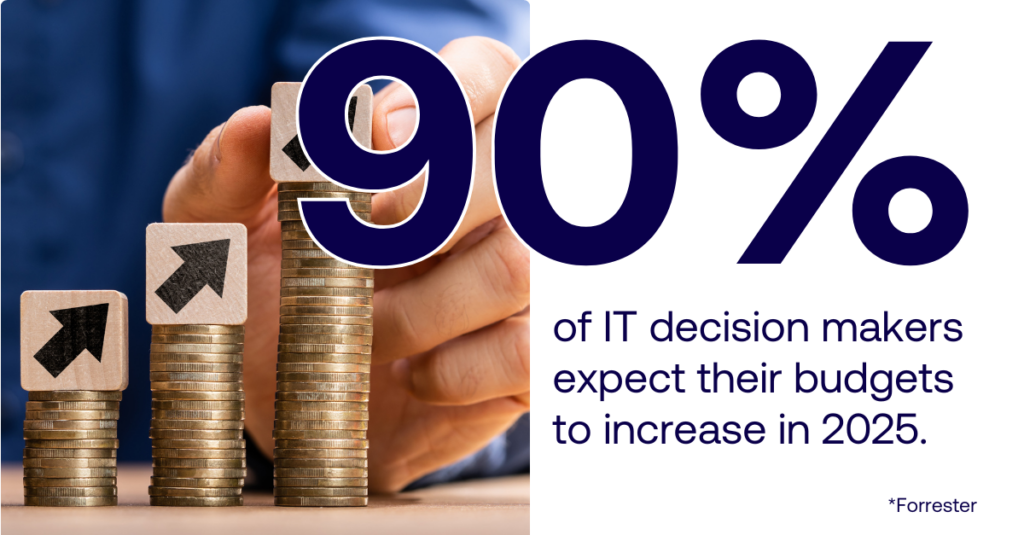

Looking ahead, Forrester reports that over 90% of IT leaders expect budget increases in 2025, paving the way for greater investment in AI, automation, and optimization. Genesis helps firms harness these technologies within “AI guardrails” — ensuring compliance and control without slowing innovation.

As Cliff Gerber, Director at Luxoft, puts it: “A question I get all the time is how can I reduce costs? And one of the ways to do that is to lower the time to delivery, and I find Genesis does that.”

Part 2: Contain, extend or replace existing solutions

The challenge: Reducing operational and regulatory risks

Maintaining outdated systems is costly and risky, but full replacements can be equally disruptive. The smartest strategy is gradual modernization, leveraging modular platforms that allow firms to transform without jeopardizing business continuity.

Our solution: Gradual, flexible modernization

Genesis enables firms to extend or replace existing systems incrementally, converting tactical tools into robust, auditable applications. This modular approach provides flexibility, control, and speed – helping firms modernize with minimal risk.

Vendor scaffolding

Vendor systems often evolve with client-specific customizations that later create dependency and technical debt. 72% of capital markets firms rely on third-party providers for mission-critical systems (Celent), but 83% have experienced a third-party incident (Gartner). Vendor lock-in and high switching costs stifle innovation.

Sumeet Chabria, Senior Advisor to Genesis Global, notes: “Financial companies have come into this stage where they’re not able to get off a vendor platform easily. We call that vendor lock-in… companies are looking at third-party risk much more closely.”

Genesis’s vendor scaffolding approach creates a flexible layer around existing systems. This “decoupling” reduces third-party risk, enhances agility, and gives firms freedom to modernize or migrate on their own terms.

Legacy Application Modernization

Legacy systems remain a major barrier to agility. 79% of organizations say legacy applications hinder digital transformation. Maintaining these systems consumes up to 50% of tech budgets for large banks (Gartner).

Genesis offers a modular, low-risk modernization framework that connects legacy and modern components in real time, preventing disruption during transitions. Pre-built components replicate and extend existing logic quickly — accelerating modernization timelines.

As Stephen Murphy emphasizes: “Bringing software applications to market quickly is the key differentiator for banks, asset managers, and other financial firms.”

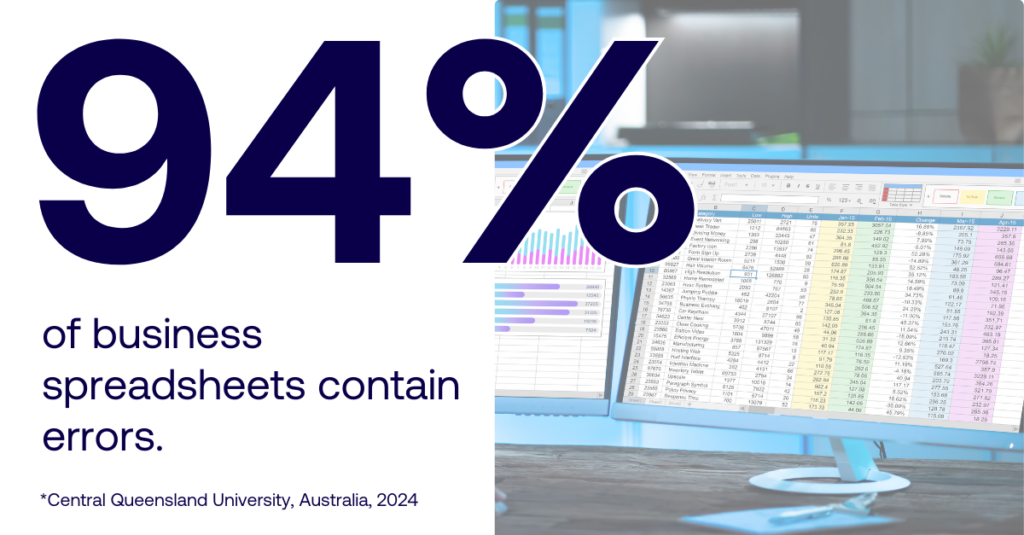

EUC Replacement

End-user computing (EUC) tools such as spreadsheets and macros remain common, but 94% of business spreadsheets contain errors, and 66% of financial institutions identify EUCs as a major operational risk.

Genesis helps firms replace fragmented EUC tools with secure, enterprise-grade applications. Reusable components and templates make the transition fast and cost-effective.

For example, the Credit Risk Insurance Application (CIA) helps firms standardize risk management workflows and improve compliance. ING uses CIA across global operations to automate credit insurance processes and reduce operational risk.

Part 3: Innovate with speed and compliance

The challenge: Innovating with limited resources

Firms must move quickly to capture opportunities, but innovation in regulated markets requires control, auditability, and scalability.

Our solution: Enabling rapid experimentation

The Genesis Application Platform allows teams to experiment, prototype, and iterate rapidly – accelerating innovation while maintaining compliance. Built-in components and templates support safe, structured experimentation without sacrificing speed.

Whitespace Innovation

Only 35% of firms are willing to pursue high-risk, whitespace innovation (Cognizant). Budget limitations, misaligned priorities between CFOs and CIOs, and the complexity of building compliant software all slow progress.

Genesis removes these barriers by providing a structured innovation environment. Pre-built components and compliance guardrails enable rapid prototyping of new financial applications – safely and efficiently.

Case in point: A leading asset manager used Genesis to develop a Primary Bond Issuance (PBI) solution, centralizing real-time market data and accelerating decision-making.

Market Infrastructure

Building regulated, high-performance systems is complex and resource-intensive. Yet, modern market infrastructure is critical for resilience and client confidence.

Genesis helps firms design and deploy tailored, scalable systems with pre-integrated protocols such as SWIFT and FIX.

Case in point: Genesis partnered with Neptune, a fixed-income data platform connecting 30+ dealers and 80+ buy-side firms. In just six months, Genesis rebuilt Neptune’s core technology, enabling the platform to process one billion messages per day while improving scalability, performance, and UX.

Overcome legacy limitations with Genesis

The financial industry is under increasing pressure to innovate while ensuring compliance and operational excellence. Legacy systems and fragmented EUC tools slow this progress.

Genesis provides a safe, compliant, and scalable platform for modernization. Its flexible “buy-to-build” approach allows firms to modernize systems incrementally, enhance vendor solutions, and replace outdated tools – all without the disruption of full system replacement.

Staying ahead of 2025 financial market trends

As 2025 unfolds, firms must balance speed, compliance, and innovation to stay ahead. Those that embrace modular modernization, AI-powered productivity, and controlled experimentation will thrive in an environment defined by change.

The Genesis Application Platform empowers financial institutions to innovate with confidence – accelerating development, reducing risk, and future-proofing operations in the evolving world of financial markets.

Start building finance-grade

applications 10x faster

Request a demo with one of our team to see how we can help you overcome these challenges.