Table of Contents

- 1. Modernize infrastructure without disruption

- 2. Turn data into a strategic asset

- 3. Unlock AI’s power with guardrails and control

- Lead the transformation today

Get in touch to learn how Genesis can help you modernize your workflows

Recommendations for financial leaders in 2025

The financial industry enters 2025 facing heightened uncertainty and rapid technological disruption. In April, the VIX Index reached its highest level since March 2020, and the Merrill Lynch MOVE Index mirrored that volatility—driven by inflation data, new U.S. tariffs, and global labor market turbulence.

At the same time, geopolitical risks are rising. The U.S. re-withdrawal from the Paris Agreement and wider policy shifts under President Trump have raised sovereign risk premiums and created uncertainty around energy and environmental regulation.

These forces are converging into a single reality: strategic transformation is no longer optional, it’s essential. Financial leaders are responding by prioritizing modernization, AI adoption, and stronger data governance throughout 2025.

According to Forrester, more than 90% of IT decision-makers report increased budgets this year. The opportunity is clear: now is the time to invest in infrastructure modernization, workflow automation, and compliant AI frameworks to secure a competitive edge.

Below are three strategic priorities for the second half of 2025:

- Modernize systems without disruption

- Turn data into a strategic asset

- Adopt AI with the right guardrails

1. Modernize infrastructure without disruption

Legacy systems are holding back innovation

Despite years of digital transformation initiatives, many firms remain tied to legacy infrastructure. These systems are costly to maintain, slow to adapt, and difficult to scale. According to NASDAQ’s Post-Trade Ecosystem Study, 78% of investment budgets are still consumed by maintaining or upgrading existing infrastructure—leaving limited resources for innovation.

McKinsey estimates that banks running on outdated core systems face operational costs up to ten times higher than peers using modern platforms. IDC forecasts losses exceeding $57 billion by 2028 for institutions that fail to modernize.

The result is not just financial inefficiency—it’s lost agility. Legacy systems slow product launches, fragment investment data, and undermine regulatory compliance. The Software Improvement Group found that 37% of legacy-built systems received a below-average architectural rating, deploying updates up to 40% slower than modern equivalents.

Modernization must be done carefully. Rather than attempting a disruptive “rip and replace,” institutions should pursue a phased, modular approach that preserves continuity, reduces risk, and aligns with long-term strategic goals.

Our recommendations:

Genesis advocates a pragmatic, low-risk modernization pathway based on three pillars:

- Build a scaffold layer around vendor platforms to modernize incrementally while reducing vendor dependency.

- Replace risky end-user computing (EUC) tools with secure, auditable systems.

- Modernize legacy systems with tailored, resilient applications designed for long-term flexibility and compliance.

This approach allows firms to innovate at their own pace, minimize disruption, and lay a foundation for scalable growth.

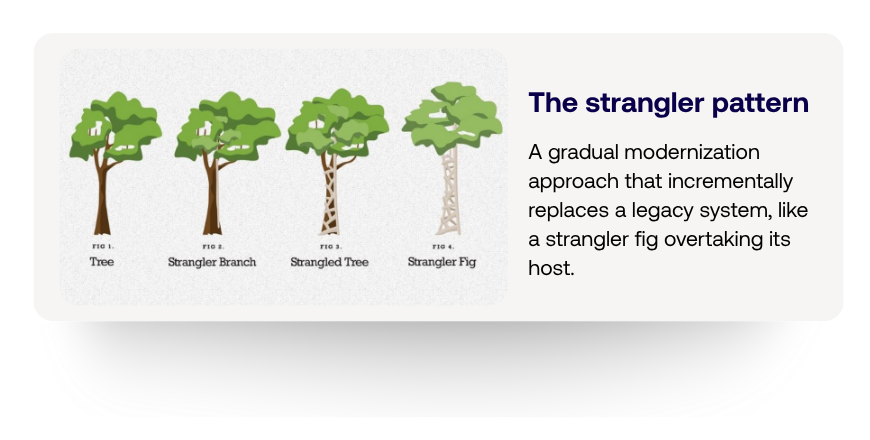

Build a scaffold layer using the strangler pattern

The first step is to construct a scaffold layer around existing vendor systems using the Strangler Pattern. This approach allows new functionalities to be built around existing environments while gradually routing legacy components through APIs and modular architecture.

It’s a pragmatic way to modernize without disrupting mission-critical operations or becoming trapped in rigid timelines.

Vendor scaffolding also reduces third-party risk – a growing concern for financial institutions. A Celent study found that 72% of capital markets firms rely on third-party vendors for mission-critical systems, while Ponemon reports that 60–80% struggle with vendor risk. Gartner further highlights that 83% of organizations experienced a vendor-related incident in the last two years.

By decoupling core functionality from vendor constraints, firms regain control of their technology roadmaps and reduce long-term dependency.

Replace risky end-user computing (EUC) tools

Modernize legacy systems

2. Turn data into a strategic asset

Bad data quality and governance costs millions

Every trade, transaction, and strategic decision relies on accurate, high-quality data. Yet, despite heavy investment, data fragmentation and integrity issues remain widespread.

Global spending on financial market data reached $42 billion in 2023, up 12.4% year-over-year. Still, 66% of banks struggle with data quality, and 58% lack proper metadata and models (SimCorp). Gartner estimates the industry loses $15 million per firm, per year, to poor data governance.

The risks extend beyond inefficiency. In 2022, Morgan Stanley was fined $35 million for mishandling customer data during a data center decommissioning—underscoring that governance failures can carry steep penalties.

Fragmented data prevents firms from achieving real-time visibility, slows trade execution, and increases compliance risks.

Our recommendations:

To unlock the full value of data, firms must centralize, clean, and govern it effectively.

- Centralize and clean your data in real time: Aggregate data from multiple systems, normalize it, and automate cleansing to ensure accuracy and consistency.

- Establish clear ownership and workflow governance: Define data stewards, enforce audit trails, and create transparent workflows for data validation and approval.

Together, these steps build the foundation for trusted, AI-ready data that supports better decision-making and regulatory confidence.

Centralize and clean your data in real time

Firms need a unified golden source of truth. Genesis enables real-time ingestion from diverse internal and external sources, powering consistent, actionable insights across the trade lifecycle.

By automating data cleansing, reconciliation, and normalization, firms can eliminate duplication, reduce manual intervention, and elevate overall data quality.

Establish clear ownership and workflow governance

Case Study: Primary Bond Issuance (PBI)

Genesis partnered with a global asset manager to build the Primary Bond Issuance (PBI) solution, centralizing real-time data from multiple sources to give portfolio managers a unified market view.

With PBI, teams evaluate opportunities faster, collaborate seamlessly, and request allocations instantly—strengthening both performance and compliance.

High-quality data also powers AI readiness. Gartner reports that 35% of CFOs cite poor data quality as the main barrier to AI adoption. With Genesis, firms ensure governance is built in from the start, enabling safe and effective AI deployment.

3. Unlock AI’s power with guardrails and control

AI adoption in financial services continues to surge – reaching $35 billion in 2023 and projected to exceed $190 billion by 2030. Yet, many firms remain cautious.

A risk-first approach is critical. Gartner reports that 45% of CEOs view AI as riskier than beneficial, citing concerns about compliance, hallucinations, and data integrity. Studies have shown hallucination rates as high as 20% in AI-generated code, and up to 58% for complex, regulated tasks.

Our recommendations

Genesis advocates a “risk-first AI” strategy – embedding AI into governed, compliant frameworks that preserve control, transparency, and trust.

Empower your developers with AI in a component-based architecture

Embed AI within a governed, component-based architecture where AI interacts only at approved extension points. Genesis ensures predictability, auditability, and compliance at every stage, empowering developers without replacing them.

Using Genesis’ AI-augmented IDE, teams can accelerate front- and back-end development while maintaining full control over logic and data flow, scaling innovation safely.

Enable your business users to build with AI safely

Audit and control AI with a Model Context Protocol Server

Lead the transformation today

In a year defined by volatility and rapid change, financial leaders must act decisively. Modernizing infrastructure, governing data effectively, and adopting AI with the right guardrails are no longer optional – they are the foundation of long-term resilience and growth.

The firms that act now will not just adapt to the future of finance; they will define it.

Want to assess your AI readiness or modernization path?

Talk to a Genesis expert to discover how to future-proof your organization with minimal disruption.