News release

Genesis launches credit insurance application

Workflow, analytics, visualization and connectivity from the Genesis Application Platform replace spreadsheets in bank lending and financing businesses

LONDON & NEW YORK – April 11, 2024 — Genesis Global launched a new solution to automate bank processes for offsetting credit risk in lending and financing businesses.

The Genesis Credit Insurance Application (CIA) helps lenders to build and manage global portfolios of credit insurance and risk participation agreements. It is applicable to a range of commercial-, investment- and transaction banking activities, including commercial lines, term loans, trade finance, project finance, letters of credit and bank guarantees.

CIA replaces a series of manual processes typically managed on spreadsheets with an integrated solution that consolidates global insurance portfolio data and facilitates efficient workflow for distributing risk. It enables banks to modernize how they reduce credit exposure while mitigating operational and financial risk in the process. Risk distribution channels like credit insurance affect how banks calculate risk-weighted assets and meet regulatory capital requirements.

“Distributing credit risk involves a complex, data intensive process that demands a technology solution to help the lender operate efficiently in building and monitoring insurance and MRPA portfolios,” said Will Brown, Sales Engineer at Genesis Global. “Our application replaces an ecosystem of spreadsheet processes with an integrated solution that helps banks scale commercial and investment banking businesses while lowering operational risk and cost.”

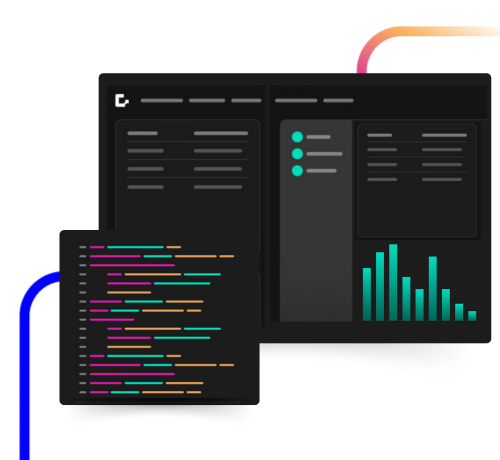

The Genesis Application Platform provides the system connectivity, workflow, analytics, monitoring tools and rich user interfaces featured in CIA. Core functionality in the solution includes:

- End-to-end workflow covering insurance RFQs, pricing, approvals, policy binding and claims

- Integrations with industry-leading loan booking platforms (e.g., LoanIQ, ACBS, Murex) and lenders’ internal systems for counterparty risk limits and reference data

- Dashboard and alerts to manage premium schedules, policy events, exposure tracking and counterparty limits

- Risk distribution portfolio monitoring and analytics

- Customizable reporting and user configurations

“Developing scalable, auditable applications to replace spreadsheets in critical business processes is a key way we help financial firms transform their technology and operations,” said Tej Sidhu, Chief Technology Officer at Genesis Global. “CIA shows how technical and business components in the Genesis platform deliver the integrations, specialized workflow, analytics, visualization and controls that drive performance and efficiency.”

About Genesis Global

Genesis Global enables financial markets organizations to innovate at speed through its software application development platform, prepackaged solutions and deep expertise in capital markets and financial services.

The Genesis Application Platform is designed with flexibility and performance at its core, providing developers with the frameworks, integrations and components required to automate manual workflows, enhance legacy systems and build entirely new applications. Featuring a resilient, real-time service-oriented architecture, Genesis excels across the performance envelope of low-latency, high-throughput and high-scalability, powering mission-critical applications at the world’s leading financial institutions.

Strategically backed by Bank of America, BNY Mellon and Citi, Genesis Global has offices in London, New York, Miami, London, São Paulo, Dublin and Bengaluru.

Media contact:

Alex Paidas, Corporate Communications, Genesis Global

[email protected] +1 646 246 4889

Start building finance-grade

applications 10x faster

Explore the Genesis Application Platform in action with a 60-day free trial* to get your first application built and in-market faster than ever before.