Table of Contents

Asset managers face challenges in accessing corporate and municipal bond primary markets due to fragmented data and limited decision-making time. Meanwhile, sell-side institutions have leveraged technology for over a decade to streamline syndication. To level the playing field, asset managers must centralize deal data, enhance market monitoring, integrate workflows, and foster collaboration. A unified system improves efficiency, accuracy and competitiveness in deal selection and execution.

Why 2025 is the year to bridge the technology gap in fixed income markets

There is a significant growth opportunity for asset managers in fixed income markets seeking to maximize returns with the asset management sector predicted to grow by 5.9% annually by 2028. Plus, with U.S. corporate bond issuance projected to exceed $1.5 trillion in 2025, there’s plenty of potential if firms can operate efficiently in this environment.

Furthermore, the municipal bond market provides promise for asset managers particularly as investors seek tax-advantaged income and stability in an uncertain economic climate. With state and local governments ramping up infrastructure spending and green initiatives, muni bond issuance is expected to remain strong, presenting ample opportunities for portfolio diversification.

Yet, while sell-side institutions benefit greatly from automated syndication technology, many buy-side firms lag behind, which puts a blocker in the way of reaching this growth.

Asset managers face fragmented data, manual workflows and limited decision windows, making it difficult to request allocations or act confidently on opportunities. These inefficiencies are further compounded by rapidly changing deal terms, often with over 30 updates communicated in just a few hours. Bridging this technology gap is critical for enabling your teams to work more efficiently and with greater accuracy.

Challenges in Primary Bond Markets

Navigating the primary bond markets comes with several critical challenges that can hinder effective decision-making and operational efficiency. These issues often stem from limited timeframes, fragmented information and outdated workflows. This puts immense pressure on firms to manage data quickly and accurately.

- Time-Sensitive Decisions: Asset managers frequently face a narrow 2–4-hour window to evaluate potential deals. This tight timeframe requires quick, informed decision-making, yet many firms lack centralized systems to effectively handle such rapid analysis.

- Fragmented Data Sources: Deal data is often scattered across multiple platforms, with inconsistent or delayed updates creating significant blind spots. Research shows that poor data quality can cost organizations up to $15 million annually due to manual inefficiencies and errors. This highlights the need for integrated data solutions to increase automation in the delivery of clean dependable data.

- Disconnected Workflows: Manual, siloed processes slow down decision-making and increase the risk of errors in trade generation, compliance checks, and order communications. A lack of streamlined workflows can significantly undermine both productivity and accuracy.

Steps to Closing the Tech Gap

Effective primary market engagement requires real-time surveillance and accurate deal tracking. While syndication tools have made several deal monitoring areas easier for asset managers, deal data remains fragmented across multiple platforms, each with frequent asynchronous updates that require swift processing. Often asset managers only have a few hours to determine and express their interest in a deal, and with fragmented data added to the mix, this process can be incredibly pressured. In 2025, we’re seeking a simpler solution to ease this pressure, enhance team efficiency and ultimately provide asset managers with greater decision-making confidence.

Centralizing and Enriching Deal Data

So, where to start? We believe the answer is in a centralized solution.

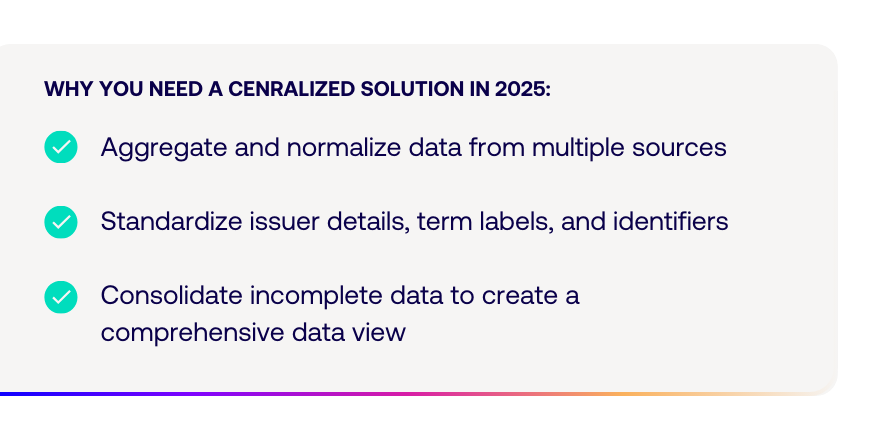

Centralizing deal data is essential for overcoming fragmentation in primary bond markets, as it can help to ensure this needed real-time surveillance and accuracy. A centralized system aggregates and normalizes information from multiple sources, standardizing issuer details, term labels, and identifiers to eliminate inconsistencies. By consolidating incomplete data into one comprehensive and centralized hub, you gain many advantages. For instance, you eliminate the need for manual entry across multiple systems, you can streamline regulatory checks and keep the entire investment team informed throughout the process. Overall, a centralized framework allows firms to gain a clearer, more efficient approach to deal evaluation.

Better monitoring

A centralized system also streamlines market monitoring by filtering deals based on size, rating, currency, industry, and ESG factors, reducing noise and highlighting relevant updates. Smart screening tools ensure portfolio managers receive only pertinent deals, while seamless trading integration automates order creation, minimizes errors, and ensures real-time regulatory compliance. By centralizing new issue data and refining deal term updates, asset managers can efficiently focus on priority opportunities and spend less time sieving through streams of asynchronous data.

Beyond aggregation, data enrichment fills gaps and enhances usability, allowing asset managers to act with speed and confidence. Automating this process transforms market engagement, providing a reliable, real-time view of opportunities in the primary market.

Collaboration and auditability

Our final reason for adopting a centralized solution to close the technology gap in fixed income markets is that it enhances communication. One way of doing this is to embed communication tools like Symphony or Teams within a unified system. This fosters seamless collaboration, accelerates decision-making, and ensures full auditability.

Furthermore, automating more processes can further maximize your investment team’s productivity. By embedding discussions, data, and decision history within the workflow, firms can create a transparent, auditable environment that enhances efficiency, accelerates decision-making, and ensures compliance.

Ultimately, by facilitating real-time connectivity between portfolio managers, credit analysts, and traders you can enable faster, more informed responses to deal opportunities.

Why act now?

The digital transformation of capital markets continues to accelerate and the ability to act quickly to keep up with the pace is how you’ll gain a competitive advantage. By implementing a centralized solution with real-time data integration, automation tools, and collaborative workflows, asset managers can eliminate inefficiencies that hold them back. Not only will this provide operational efficiency, but it will also open new growth opportunities in a highly competitive primary bond market. What is your firm waiting for?

Learn how to address your technology gaps to explore new growth opportunities with us today.