Table of Contents

Now that InvestOps is over, we’re reflecting on the key discussions that took place in Orlando. In this blog, we share insights from an engaging panel discussion featuring Genesis CEO Stephen Murphy, Strategic Accounts Director Liz Matkowski, and Sales Engineer Will Brown. They explored the critical challenges financial institutions face in modernizing back-office operations and how firms can embrace innovation without the risks of a costly rip-and-replace strategy. Read on to discover how incremental modernization, leveraging approaches like the strangler pattern, can drive efficiency, reduce risk, and ensure operational longevity.

The urgent need for modernization

Operational inefficiency hinders business growth, and for many financial institutions, the back office is an area in desperate need of transformation. Legacy systems, disparate processes, and outdated architecture often create bottlenecks that limit operational efficiency, increase costs, and undermine agility. Modernizing back-office operations is no longer an option; it’s a necessity.

Operational efficiency as a strategic imperative

Operational efficiency is a strategic priority for financial institutions. According to the NASDAQ Post-Trade Ecosystem Study, 78% of investment budgets are allocated to maintaining or upgrading legacy systems, leaving little room for innovation.

Meanwhile, research from McKinsey reveals that banks relying on aging core systems face operating costs that are 10 times higher than those using modernized technologies. This inefficiency not only strains resources but also makes firms more susceptible to competitive pressures and industry disruption in the following ways:

- Risk & Complexity: Proprietary systems often have undocumented functionality, making them complex and difficult to replace. Missteps in overhauling legacy systems can jeopardize business continuity and expose firms to operational risks.

- Business Continuity Concerns: Shutting down or overhauling a system critical to day-to-day operations can lead to downtime, which is a risk few institutions are willing to take.

- Flexibility & Resource Strain: Legacy systems are ill-suited for modern needs. Replacing or extending these systems demands significant investment in time, money, and developer talent.

Institutions are trapped between maintaining outdated systems and undertaking risky, large-scale replacements. A less disruptive and more pragmatic approach to modernization is clearly needed. One way of looking at approaching this is using the strangler pattern.

The strangler pattern

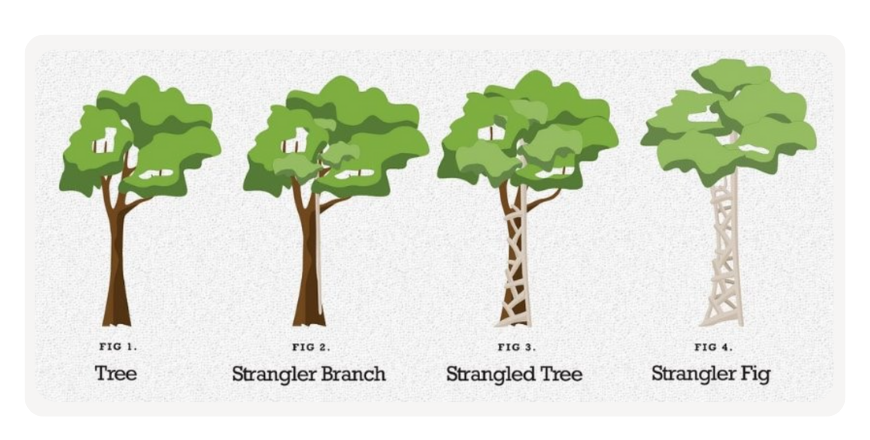

The Strangler Pattern, inspired by the growth of strangler fig trees, offers a practical approach to modernizing legacy systems incrementally. Instead of disruptive overhauls, this method allows financial institutions to replace outdated components step by step. It works by introducing new system parts that coexist with the old, using an API-first approach to route functionality through the modern system while maintaining the legacy infrastructure. Over time, the legacy system is phased out and removed entirely.

This strategy is highly effective because it avoids downtime, ensures modular improvements in manageable increments, and minimizes operational risks. Unlike a ‘rip-and-replace’ model, this approach enables seamless modernization while maintaining business continuity.

Rethinking the operating model

Adopt unified systems for faster product launches

A Gartner CIO and Technology Executive Survey identifies disjointed systems as a significant challenge. 47% of firms cite slow product launches and fragmented investment or risk views as major operational barriers. When systems don’t communicate efficiently, they hinder agility and impede an institution’s ability to innovate.

A unified portfolio management approach, powered by API-driven architecture, provides the solution. This approach integrates disparate systems, streamlines workflows, and improves speed-to-market. In turn, a unified approach empowers organizations to scale, innovate and adapt faster than traditional setups, creating a clear path to success. But what does this look like in a practical setting?

A practical solution for legacy modernization

As we’ve highlighted, modernizing back-office systems doesn’t have to mean opting for a costly rip-and-replace strategy. Here’s how to address key challenges while minimizing risk and cost:

Build a scaffold layer around your existing vendor

Decouple client functionality from vendor systems to reduce dependency and vendor-related risks. By maintaining control over key system operations, institutions can introduce changes without waiting on lengthy vendor timelines.

Modernize your legacy systems

Enhancing existing core systems can extend their lifespan while introducing modern features and improving efficiency. With many firms allocating 50%–67% of their tech budgets to maintaining existing infrastructure, controlled legacy modernization is both cost-effective and strategic.

Replace your EUCs

Replace End-User Computing (EUC) tools, such as ungoverned spreadsheets, with scalable and auditable software. Spreadsheets are error-prone and lack the robust functionality needed for regulatory compliance and long-term growth. In fact, 94% of business spreadsheets contain errors, proving that outdated EUCs are risky for your business. Therefore, their replacement should be a high-priority task.

Best practices for successful transformation

Modernization is a complex process, but these tips can help institutions achieve their goals effectively:

- Incremental growth: modernize one system component at a time to reduce risk and maintain functionality.

- Allow old and new components to coexist: Enable new and old components to operate side by side during migration, ensuring continuous service.

- Gradually add new features: Gradually introduce new technologies and solutions, addressing immediate business needs while planning for future innovations.

- Prioritize: Focus modernization efforts on areas where the potential for impact and ROI is highest.

The Future of Back-Office Transformation

Modernizing back-office operations is an ongoing process. Large-scale rip-and-replace strategies are outdated, posing risks that far outweigh their benefits. Instead, a scalable and continuous modernization approach is the key to achieving operational efficiency and innovation.

At Genesis, we specialize in providing financial institutions with the tools they need to modernize their back office. Our application development platform empowers organizations to reduce risk, improve efficiency, and bridge the gap between legacy systems and future innovations with ease.

Are you ready to streamline your back office? Contact us today to begin your transformation.