Table of Contents

- The challenge of reporting in the middle office

- Overcoming reporting gaps with targeted solutions

- Extending beyond the middle office

- Next steps to fill your reporting gaps

Get in touch to learn how Genesis can help you modernize your workflows

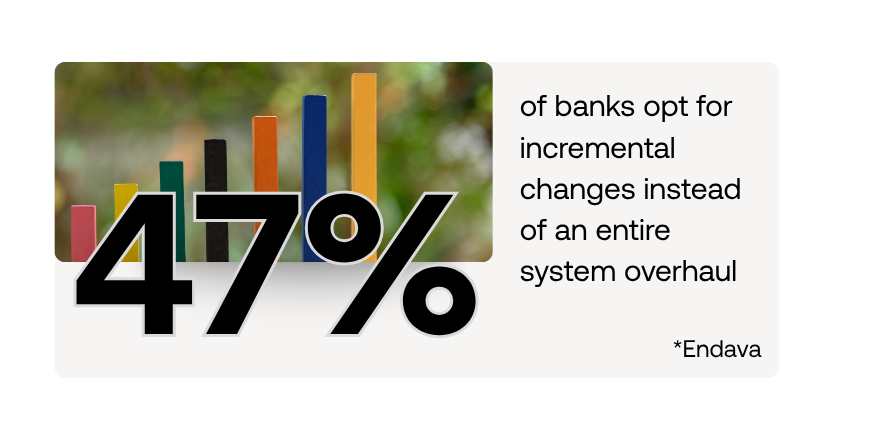

Upgrading an entire middle office system poses significant resource and risk challenges. In fact, a report from Endava found that only 13% of banks opt for full system replacements due to the potential disruption. Many firms face delays or disruptions when considering full-scale replacements, especially when existing vendors are deeply embedded. In the Endava study, most banks (47%) opt for incremental changes instead of an entire overhaul.

Driving improvement starts by targeting manageable areas with the highest impact. Reporting acts as an interface for compliance, operations, and client service. For middle office teams, it is both a critical function and a signification operational overhead.

By addressing reporting gaps, firms can quickly improve efficiency, mitigate regulatory risk and set the foundation for broader process enhancements without overhauling their entire technology stack.

The challenge of reporting in the middle office

Reporting processes in the middle office are often manual, inconsistent, and slow. This is driven by legacy systems and fragmented data sources across front office platforms, custodians and clearing houses. Persistent data silos make the issue worse. These challenges are further intensified by growing regulatory obligations and increasing pressure to meet both internal stakeholder expectations and complex client reporting demands. Manual reporting often relies on copying and pasting data, which is error-prone and resource-intensive. According to a McKinsey report, financial institutions spend 30-40% of reporting time on data collection and validation, not on analysis or value-added work.

In addition, different teams often use inconsistent formats, leading to confusion and rework, adding another layer of inefficiency. Outdated or inaccurate information leaves executives with weak insight into business performance, which can increase the risk of poor strategic decisions.

Another critical reporting requirement in the middle office involves regulation, where non-compliance with regulatory requirements can lead to financial penalties, reputational harm, and, in severe cases, more serious legal or operational consequences. Plus, regulatory frameworks such as TRACE (FINRA’s Trade Reporting and Compliance Engine for fixed income securities) and MiFID II (the Markets in Financial Instruments Directive in Europe) require firms to capture and report highly detailed transaction data. MiFID II alone requires reporting over 65 data fields per transaction.

Overcoming reporting gaps with targeted solutions

Incremental improvements beat full-scale overhauls when resources are limited, with 42% of banks declaring plans to replace elements of their legacy tech stack in the next year (10X Banking study). The most effective starting point is automating and standardizing reporting processes.

Here’s how targeted solutions address common middle office challenges:

- Automation

Automating trade, risk and regulatory reporting eliminates manual steps and reduces errors. Automated systems consolidate trades, allocations and transactional data, delivering files in standard formats via SFTP, FIX or custom channels for compatibility with downstream settlement and regulatory systems.

- Timely accurate data

Real-time data capture and integration ensures reports are built from up-to-date, accurate information, providing real-time operational insights to stakeholders across the front, middle and office.

- Regulatory flexibility

Solutions must adapt to the evolving requirements of global regulators. Modern reporting tools can handle regional rules like TRACE and MiFID II out of the box, creating and delivering the required audit trails at scale.

- Client reporting

Improved middle office reporting makes client reporting more accurate, timely, transparent, and responsive. This is key to sustaining strong, long-term client relationships.

Institutions that focus on reporting upgrades away from manual processes report faster cycle times, improved risk oversight, and fewer compliance breakdowns. Moreover, banks with modernized systems report operational cost savings of up to 25% and reduced operational risk by up to 30%. By delegating repetitive report-building to an automated solution, teams can focus on insight, not data wrangling.

Extending beyond the middle office

Reporting challenges are not limited to the middle office. Across the trade lifecycle, inefficiencies appear wherever data is tracked, shared or filed.

- Front office

Trade reporting, which provides transaction details to regulators or exchanges, is typically managed through front-office systems. Accurate and timely reporting requires seamless connection between trade capture platforms and automated regulatory deliverables.

- Back office

Settlement and transaction reporting in the back office relying on accurate upstream data. Reconciliations and notifications must sync across divisions to avoid mismatch or settlement failure.

- Holistic solutions

The most usable platforms support reporting, notifications and reconciliations across all areas. They can be configured to match specific business logic or compliance requirements at any point in the lifecycle.

Overcoming reporting issues across any area of the trade lifecycle requires a scalable solution to reduce reliance on piecemeal workarounds. By configuring a robust reporting tool with specific business logic, wherever gaps appear, reduces operational risk and enhances reporting efficiency.

Next steps to address your reporting gaps

Targeting and resolving reporting issues in your middle office can unlock efficiency, improve client relationships, and reduce compliance burden without a full system replacement. Identify your most pressing pain points, prioritize automation for high-impact reporting, and adopt flexible solutions that can adapt to evolving compliance requirements and strategic business objectives.

To assess your current reporting gaps and explore targeted solutions that improve efficiency without major disruption, connect with our team. We can help you address the pain points in your middle office and beyond.