The Impact of End User Computing on Financial Services

End User Computing (EUC) has been a problem across a number of industries, but the precision required and risks associated with errors in financial services set it apart when assessing the impact.

So, what is End User Computing?

There are many definitions of End User Computing, but the one I like to use is:

“Tools and systems created outside of formal development processes, usually by end users, to solve specific problems within their own roles.”

While financial institutions rely heavily on data-driven decision-making, many critical processes still depend on EUC solutions – spreadsheets, manual databases and outdated applications. These tools might offer some familiarity but present significant and often overlooked risks. As such, EUC replacement often becomes a key pillar in digital transformation strategies across these institutions.

Risks and Consequences

There is a real-world cost to spreadsheet errors. Financial history is rife with significant losses caused by spreadsheet miscalculations. For instance, the infamous “London Whale” trading incident at JPMorgan Chase in 2012, which resulted in losses of over $6 billion, was partly attributed to errors in a complex spreadsheet model used to track exposure. Even simple formula errors or incorrect data entry can have severe consequences.

Another first-hand example occurred at a tier 1 bank many years ago when one of my developers went on his annual two-week core leave. Commonplace in many banks, this triggers an account disablement policy, in which contact with work is prohibited. However, when this developer left, one of our smaller trading systems stopped working. We discovered that the application was hosted on the PC under his desk, and when his accounts were disabled, access to the application also ceased. At the time, there was a mad rush to get his accounts reinstated, but looking back, it was quite a comical event highlighting the need to build robust and industrialized applications for core processes and functions.

Beyond these two more extreme examples, here are some common risks you might face with EUCs:

- Decentralized data and audit issues

EUCs scatter crucial financial information across systems and personal devices, hindering the ability to demonstrate a clear audit trail. Adhering to continuously evolving regulations like GDPR or MiFID II is nearly impossible when data resides on individual spreadsheets.

- Outdated processes and evolving standards

While the creation of EUCs is usually dynamic, they ironically become inflexible, making it difficult to adapt new processes as compliance standards change.

- Data breaches and leaks

EUCs often lack robust security features, access control and standardization, leaving sensitive financial data vulnerable to unauthorized access or breaches. A single security lapse can lead to severe consequences and loss of client trust.

- Knowledge retention

High numbers of critical EUCs outlive the tenure of the people who built them. This leads to people not understanding what was built, how it works or how to change/fix it when it goes wrong.

- Support costs

Due to the non-standardized and disparate methods used to create EUCs, support overheads increase over time if EUCs are not managed effectively. They are also rarely backed up effectively causing a significant amount of time to recover if something goes wrong.

A number of use cases built on the Genesis Application Platform have systematically resolved these issues and risks including the introduction of our CIA (Credit Insurance Application) application that was built to replace a myriad of spreadsheets that managed the credit insurance business across the industry, consequently minimizing operational risk and enabling businesses to scale.

Not All EUCs are Created Equally

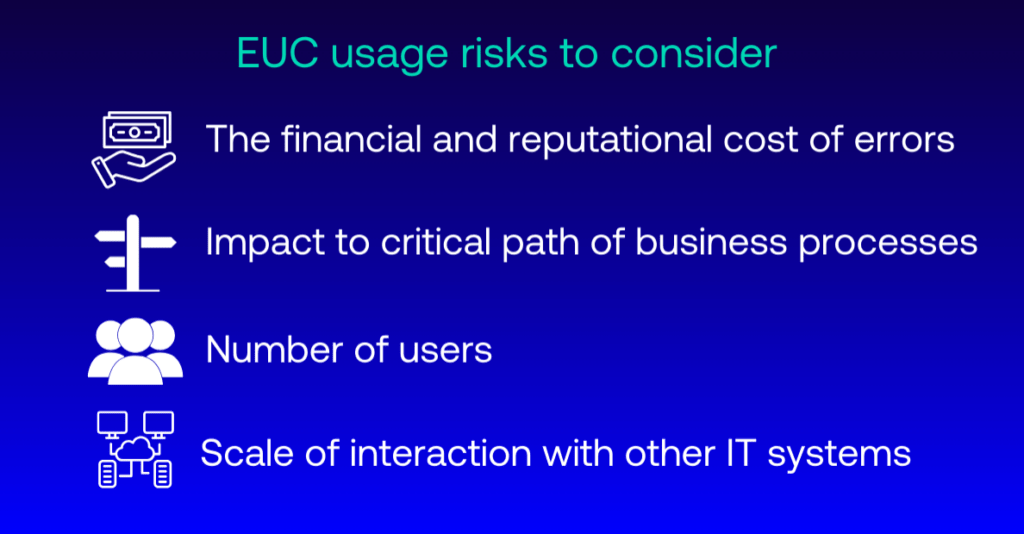

Not every EUC needs to be scrutinized to the same level. Being able to balance ad-hoc solutions against risks to the company is an important concept. As such, the following are criteria for determining appropriate EUC usage. Scoring low on all of these may mean that the EUC can be risk accepted:

The Productivity Paradox

While EUCs might seem to promote individual productivity, they ultimately stifle it at an organisational level. IT teams dedicate significant resources to troubleshooting and updating EUCs, diverting focus from innovation. Manual processes fuelled by spreadsheets and disparate systems are time-consuming, prone to errors and limit overall agility.

The Path to Modernization

These risks should not be ignored. Seek out modern solutions specifically designed for financial services. Prioritize systems with centralized data management, robust audit trails, compliance-focused features, strong security protocols, workflow automation and intuitive user interfaces.

Investing in the Future

Modernizing by replacing EUCs offers tangible benefits:

- Mitigated risk: reduce the likelihood of compliance failures, costly errors, and security breaches.

- Boosted efficiency: streamline operations and improve productivity.

- Confident decision-making: base decisions on reliable, easily accessible data.

- Protected reputation: safeguard client trust and your market position.

Don’t allow reliance on outdated EUCs to jeopardize your institution’s success and security. Proactively modernize your technology infrastructure and achieve the accuracy, efficiency and security demanded in today’s financial landscape.

Start building finance-grade

applications 10x faster

Explore the Genesis Application Platform in action with a 60-day free trial* to get your first application built and in-market faster than ever before.