The Rise of Algorithmic Trading

A question I often hear is, “How will the AI revolution shape the trading world?” The truth is, AI has been shaping trading for decades. Algo trading, by some definitions, is a form of AI. Algos are automated programs that execute trades based on predefined rules and technical indicators. By analyzing vast amounts of market data in milliseconds, they can capitalize on micro-opportunities humans would otherwise miss. Algorithmic trading now accounts for a significant portion of daily trading volume, increasing market liquidity and reducing spreads.

Most people wouldn’t consider a traditional VWAP (Volume-Weighted Average Price) algo to be “AI” because a human provides it with predefined parameters and rules. But what about a VWAP algo that alters its parameters based on the data it receives? These are used all the time in the way of a peg, which responds to price changes of whatever reference is set to change the limit price of orders in the market.

It’s very apparent that algo trading is becoming increasingly more capable over time. There are already many companies who are using vast amounts of historical data to train their algorithms so that the algo itself can decide exactly how and where to trade each individual order it receives.

Beyond Algorithmic Trading

News and Sentiment Analysis

So far, we have explored one particular way AI is changing the trading landscape, but there are countless less apparent cases. One that started to emerge a decade or so ago is Natural Language Processing (NLP) for news analysis.

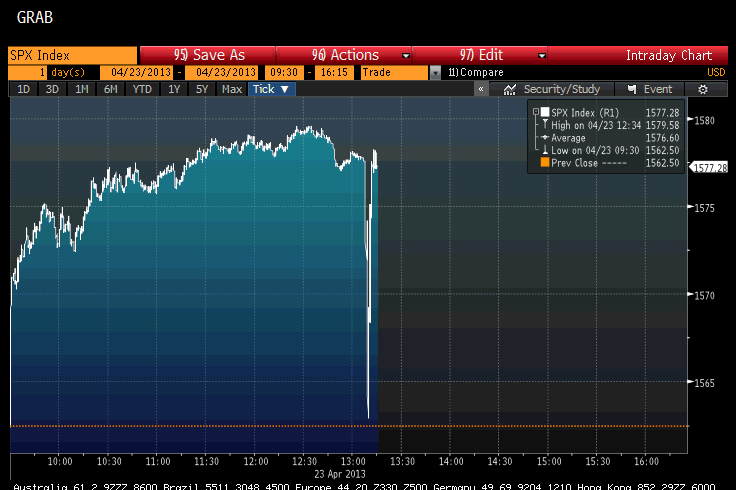

On April 23rd, 2013, the Twitter (X) account for the Associated Press was hacked, and a tweet was sent out. This resulted in a brief crash of several major US indices, as seen in the picture below.

“Breaking: Two Explosions in the White House and Barack Obama is injured.”

You can see where the automated news analysis kicked in and started trading based on this news. The market quickly recovered after the report was confirmed false just a few minutes later.

This is an extreme example of how AI has caused market movements. Programs analyze news all day long, looking for opportunities to buy and sell securities before other people can react.

There are a number of deployed strategies that have a direct impact on daily trading, but I want to touch on some of the unsung heroes of AI use cases on the trading desk.

Structuring Unstructured Data

Several asset classes and trading desks rely on reading data from sources like emails, chats and PDF files. Until recently, this required humans to read, analyze and extract the relevant information before inputting it into trading or settlement systems. We have built this functionality into our Primary Bond Issuance application.

At Genesis, we use AI to revolutionize how asset managers conquer the corporate bond primary market by efficiently processing complex data from unstructured sources like emails and chat messages. A private LLM, custom-built for institutional capital markets, not only ensures data security and task specificity but also optimizes operations, enabling accurate and real-time decision-making in time-sensitive markets.

Discover the Primary Bond Issuance Application

Building Applications at Scale

Another AI use case is for building applications. Since the rise of LLM (Large Language Model) based Generative AI systems such as Chat-GPT and Google Gemini (formerly Google Bard), we have seen people generating code blocks and functions to perform certain tasks. This can be done in various programming languages with mixed results, as the output often largely depends on the accuracy of the prompts given to the LLM.

Within the Genesis Application Platform, we have developed a private LLM trained on our platform documentation, libraries and existing applications, which can accelerate development. AI-based auto-completion and a generative AI co-pilot allow developers to build applications on the Genesis platform more easily and efficiently than ever before.

The Regulatory Landscape

As AI continues to permeate trading, a robust regulatory framework is crucial. Key considerations include:

Transparency and Explainability: Algorithms should be designed to explain their decision-making processes. This allows regulators to ensure fair market practices and prevent manipulation.

Algorithmic Bias: AI algorithms, like any data-driven system, are susceptible to bias. It’s essential to develop and employ diverse datasets and rigorous testing to mitigate bias in AI-driven trading.

Human Oversight: Regulatory frameworks should prioritize human oversight of AI systems to ensure responsible use and prevent unintended consequences.

Augmentation not Replacement

AI is not here to replace human traders. It serves as a powerful tool that can augment human capabilities, leading to a more efficient, data-driven, and potentially profitable trading environment. As AI continues to evolve, the key lies in striking a balance between leveraging its power and ensuring responsible and transparent use in the trading landscape.

Start building finance-grade

applications 10x faster

Explore the Genesis Application Platform in action with a 60-day free trial* to get your first application built and in-market faster than ever before.