Table of Contents

Overhauling an entire middle office can be daunting, and often, not possible due to being locked into an existing vendor. For many financial institutions, the risks, resources and internal disruption involved can delay or even prevent progress.

Yet, most middle office leaders know their existing processes are slowing them down, and that leaving loose ends unchecked may lead to cost, compliance and efficiency issues. One approach is to focus on fixing the gaps first. By identifying areas where workflows are less streamlined or manual, firms can build a foundation for efficiency without unnecessary overhauls.

Common gaps in the industry that we see include reporting, reconciliations and notifications. Inefficiencies or gaps in middle office processes can lead to settlement failures, compliance issues, or reputational damage. Here we explain the impact these pain points can cause in post trade workflows and outline steps to address them.

Reporting gaps undermine decision-making and compliance

Accurate and timely reporting is essential for decision-making, regulatory compliance and risk management. Yet financial institutions spend 30-40% of their time manually collecting and validating data to report on rather than analyzing it (McKinsey). And this manual reporting brings a high risk of errors. Outdated or inconsistent formats create confusion across teams and can cause delays in delivering vital information to regulators and business leaders.

One way to standardize your reporting process is by automating the export and delivery of trade, allocation and summary data to downstream systems by creating a single source of truth for all trading activity. Adopting a standalone, self-service reporting solution frees teams to configure reusable reporting templates. These templates combine the flexibility of traditional EUC tools like Excel with the control features of financial-grade systems, including auditing, permissioning and scheduling.

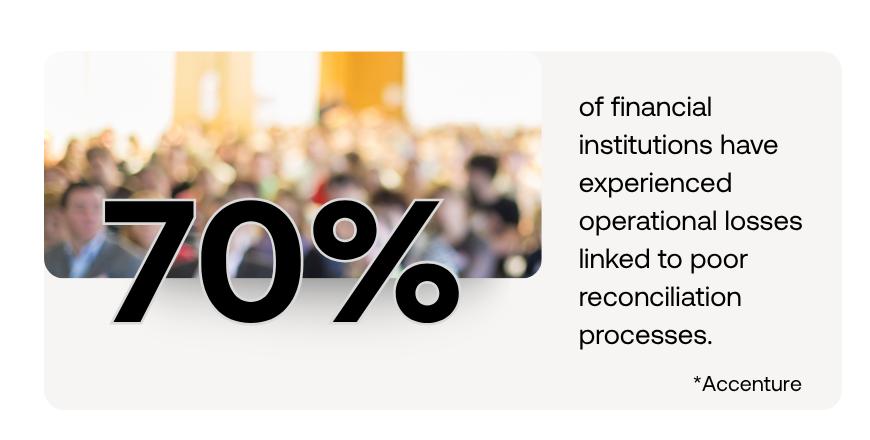

Reconciliation issues increase costs and risk

Every mismatch between systems involved in post-trade processes increases processing costs and operational risk. A study by Oracle and Accenture found that more than 70% of financial institutions have experienced operational losses linked to poor reconciliation processes.

Manual reconciliation also increases the risk of failed trades. According to DTCC, failed trades cost the financial industry up to $3 billion annually in processing costs. Manual or fragmented processes fall short of ensuring prompt, precise trade matching, risking delayed settlements and penalties.

Reducing these risks starts with workflow-based reconciliation tools that can automate trade matching against both client instructions and external services. By integrating real-time reconciliation tools into middle office processing, breaks can be surfaced sooner, allowing organizations to resolve mismatches faster and minimize human error. Real-time reconciliation reduces failed trades, supports regulatory timelines, and lowers overall processing costs.

Notification and alert fatigue threaten compliance

Another common gap we come across frequently in post trade discussion is insufficient alert processes. Missing or ignoring critical notifications can have serious financial and regulatory consequences. Gartner reports that 45% of financial professionals miss important alerts due to information overload or poor prioritization. This commonly happens when there is no obvious audit trail of whether alerts have been actioned, and if they have, by who. Moreover, alert fatigue arises when users are flooded with low-priority or poorly targeted notifications. If escalation mechanisms are missing, threshold breaches may go unnoticed until after regulatory deadlines have passed, or issues escalate into costly problems.

The key to solving this challenge lies with notification systems that provide real-time, configurable rule-based alerts. Users set personalized rules to receive targeted updates by email, chat, or in-app notifications based on their role. It’s critical to maintain a searchable log and support escalation chains, ensuring urgent issues are addressed promptly. When notification and alert systems are integrated into the workflow, the entire team can respond proactively to key events such as trade breaks or failed transactions.

“Genesis acts as the glue. We’re good at bringing different systems together.”

– Niketta Postlethwaite-Williams

The bottom line is, whatever the middle office gap, your solution must be able to scale easily, adapt to business changes and reduce the friction of adding or updating middle-office processes.

How to close your middle office gaps

Whether you seek to tackle a single gap or orchestrate a larger transformation, managing middle office workflow pain points with a modular, API-first solution supports faster deployment and ongoing scalability. If you’re ready to help your business bridge operational gaps while building a stronger foundation for efficiency, growth and compliance, explore solutions like our Trade Allocation Manager.

Talk with our middle-office experts to see how you can start addressing your middle office pain points and building resilience for the future.

Start building finance-grade

applications 10x faster

Explore the Genesis Application Platform in action with a 60-day free trial* to get your first application built and in-market faster than ever before.