The best investment you’ll ever make

In primary markets for bonds, time is money, literally. We help asset managers consolidate deal data and accelerate decision making to capitalize on fast moving opportunities. Ready to get a full view of the market and invest smarter?

Smarter investments start with a complete view of the primary markets

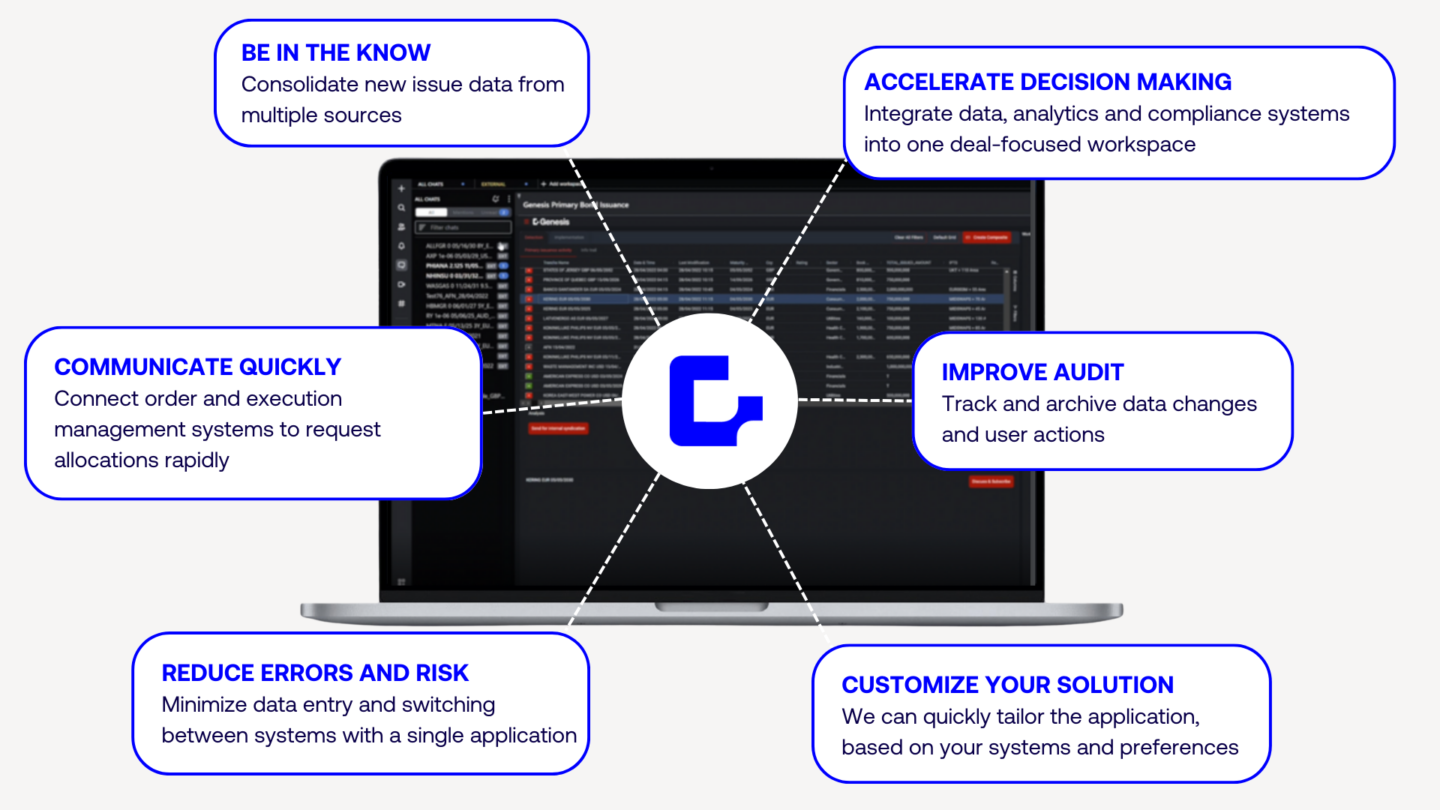

Getting into the best bond deals requires data and efficient teamwork. Our ready-to-deploy solution aggregates deal data from all of your sources to give you a central, real-time view of the market. It integrates your analytics, compliance and trade systems to provide a unified, efficient environment for primary market investment process. Embedded collaboration and workflow tools help traders, portfolio managers and analysts evaluate deals and request allocations quickly.

Never miss an opportunity. Start making smarter and faster investment decisions today.

The Buy Side Fixed Income Advantage

Asset managers need to identify opportunities in bond markets, make investment decisions and communicate orders quickly. Here’s how Genesis can help.

Confronting the Challenges in Primary Bond Market Workflows

Ben Jefferys, VP Sales Engineering at Genesis Global speaks with Trader TV on the issues of the primary bond market workflows.

Browse our primary bond market resources

Ending technology asymmetry in primary markets for bonds

Asset managers are playing catchup in primary markets technology after banks invested heavily in automated book building. Genesis’ solution helps firms monitor the market, evaluate new deals and quickly communicate orders.

Read BlogPrice transparency and bonds: What asset managers can learn from the grey market.

How to bring valuable price intelligence from the grey market into the investment process.

Read BlogBuy side demands better data aggregation for primary corporate bonds

With electronification and tech development increasing in fixed income, participants are looking for better data access in the primary market for corporate bonds.

Read ArticleBond issuance: how to improve market surveillance and deal selection

With only a few short hours to make decisions before syndicate books are closed, centralizing data and connecting systems into a unified environment presents a valuable opportunity for asset managers.

Read ArticleScalable. Collaborative. Efficient.

Learn more about the features and benefits of introducing fixed income electronification to your business.

Read FactsheetCase Study: Reduce time-to-market. Maximize ROI.

The primary bond issuance application was delivered on Genesis’ SOC-2 certified SaaS platform in less than 4 months, providing a superior time-to-market at lower cost than alternative solutions.

Read Case StudyTrusted by leading financial institutions

See Genesis in action

Schedule a conversation with our team to explore how our platform and solutions could help you.

Request a Demo